A strong record for total shareholder return

Bunzl has a strong track record of performance, which combined with its resilience, growth prospects, cash generation and financial headroom, presents an attractive long-term investment opportunity.

Consistent and proven compounding strategy

Profitable organic growth

We use our competitive advantage to grow market share in a profitable way

Operating model improvements

We have a daily focus on making our business more efficient

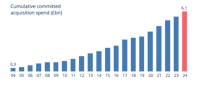

Acquisition growth

We use our strong balance sheet and excellent cash flow to consolidate our markets further

+9% adjusted operating profit CAGR (04–24)*

Track record

Acquisitions since 2004

Self-funded committed acquisition spend since 2004

return on invested capital; consistently well ahead of Group WACC

*alternative performance measure

Profitable organic growth

Using our competitive advantage to support the growth of our customers and to increase our market share.

Volume

- Sell more to existing customers

- Expand our product range

- Win new customers

- Market-leading customers

- Growing sectors

- Trend to outsourcing

Price

- Inflation

- Market dynamics

- FX impact

Mix

- Own brand/imports

- Manufacturer brands

- Geographies and sectors

- Sustainability

Operating model improvements

Small improvements we make every day, everywhere lead to significant progress over time.

Warehousing

- Consolidation of warehouse footprint

- Continually evaluate and upgrade facilities including environmental initiatives

ERP implementations

- Warehouse management systems

- Vehicle routing and safety systems

- CRM systems

Digital capabilities

- Investment in e-commerce capabilities

- Focus on digital marketing

- Opportunity for efficiency gains

Sharing best practice

- Make use of collective resources, experience and expertise

- Global collaboration

Global purchasing

- Substantial purchasing synergies with suppliers

- Benefit from Bunzl Asia sourcing centre based in Shanghai (sourcing, QA and QC)

Acquisition growth

We seek out businesses that satisfy key criteria, including having good financial returns often in resilient and growing markets, while at the same time providing opportunities to extract further value as part of the Bunzl Group.

Acquisition growth

We seek out businesses that satisfy key criteria, including having good financial returns often in resilient and growing markets, while at the same time providing opportunities to extract further value as part of the Bunzl Group.