Funding sources

Bunzl’s core funding comprises bank facilities, US Private Placement Notes and Public Bonds.

Credit ratings

The Group’s debt is rated by Standard & Poor’s as BBB+ (since November 2017) with a stable outlook.

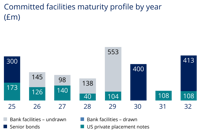

Maturity profile

Outstanding Public Bonds

| Issuer | Currency | Amount | Coupon | Issue date | Maturity |

| Bunzl Finance plc | GBP | 400m | 1.500% | 30/10/2020 | 30/10/2030 |

| Bunzl Finance plc | EUR | 500m | 3.375% | 09/10/2024 | 09/04/2032 |

| Bunzl Finance plc | GBP | 250m | 5.250% | 18/03/2025 | 18/03/2031 |

| Bunzl Finance plc | GBP | 250m | 5.750% | 18/03/2025 | 18/03/2036 |

The Public Market core issuance programme, which was originally launched in 2020, is a £2billion Euro Medium Term Note programme. This is listed on the International Securities Market of the London Stock Exchange and is guaranteed by Bunzl plc.

EMTN Admission Particulars (21 July 2020)

EMTN Admission Particulars (20 November 2023)

EMTN Supplementary Admission Particulars (20 September 2024)

EMTN Admission Particulars (13 November 2024)